08. Land (Zoning Value Sharing) Bill 2024

On the 12th of September 2024, the Minister for Housing, Local Government, and Heritage published the newly titled Land (Zoning Value Sharing) Bill 2024. According to the Explanatory Memorandum which accompanied the Bill, the purpose of this bill is to (inter alia) “introduce a mechanism to ensure that a proportion of the value of certain land that is attributable to public decisions in relation to the zoning and designation for use of such land for development purposes, is shared with the State in the interest of the common good.”

Legislation

This legislation builds upon the General Scheme of the Land Value Sharing and Urban Development Zones Bill, which was first published in December 2021 and further updated in April 2023. The Land Value Sharing (LVS) Contribution will apply in addition to existing obligations under Part V, the Residential Zoned Land Tax (RZLT), and Section 48/Section 49 Development Contribution schemes. The LVS payment will be imposed as a condition of granting planning permission for specific types of land development.

The payment applies to residential, commercial, and industrial zoned lands as well as designated SDZ lands with the revenue being allocated by the Government and Local Authorities – “to provide and in relation to public infrastructure and facilities, to carry out works and take related measures, to benefit communities and increase the supply of suitable land available for residential development.”

Section 7 of the Bill states that each planning authority shall, not later than the 1st of October 2025, prepare a map in respect of its functional area, identifying land that was, on the 1st of September 2025 “relevant land” and “section 653K land”. Once the map is prepared, the Local Authority will have to publish a notice on its website and in at least one local newspaper. The Bill does not include an appeals process for the inclusion of lands on the map.

Housing for All Q2 Progress Report

The Housing for All Q2 Progress Report (July 2024) states that “Detailed drafting of the Land Value Sharing Bill is currently underway in conjunction with the Office of Parliamentary Council (OPC). The drafting is being informed by a report by the Joint Oireachtas Committee on Housing, Local Government and Heritage containing recommendations, following pre-legislative scrutiny, and by legal advice received by the Attorney General’s Office (AGO) in February 2024. Upon completion of drafting, the Bill will be brought to Government for approval and introduced to the Oireachtas in Q3 2024.”

- The LVS payment will be set at 25% of the difference between the zoning date market value (ZDMV) and the zoning date use value (ZDUV) of the land, reduced from the 30% originally proposed in the 2023 General Scheme. These values are based on the “zoning date” which refers to the most recent date the land was either zoned or re-zoned in a County Development Plan or Local Area Plan. It can also apply to the date when the land was designated as part of an SDZ.

- The payment will apply as a condition of planning permission for developments on newly zoned land from the 1st of December 2026, and for all other relevant land from the 1st of December 2028.

- “Newly zoned land” refers to land that is not relevant land prior to the 1st of December 2024 and is relevant land on the 1st of December 2026.

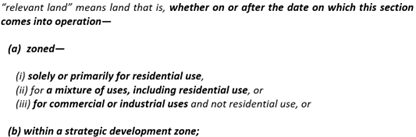

- “Relevant land” refers to the residential, commercial and industrial zoned lands as well as lands within SDZs.

- The payment will not apply to planning permissions for residential developments with fewer than 5 units or commercial developments with less than 500 sqm of gross floor space.

- Payment must be made before a commencement notice for development is submitted (unless it has been paid in advance), or it will become a charge on the land, recoverable as a simple contract debt by the planning authority.

- The Minister may allow for the repayment of all or part of the zoning value payment if the completed development includes cost rental, social and affordable housing.

- The payment should not apply to the conversion or re-construction of existing buildings to create one or more dwellings, as long as at least 50% of the building’s existing external fabric is retained.

- Landowners of relevant land included in a map must provide the Local Authority with an assessment of the ZDMV and ZDUV within six months of the map’s publication notice.

The above Planning Insight prepared by John Spain Associates provides an overview of key aspects of the Bill. For further information, you can access the full Bill via: Land (Zoning Value Sharing) Bill 2024 and the associated document via: Explanatory Note.

If you would like to discuss the Bill further, please contact our team at JSA.